Inheriting a house can be both a blessing and a challenge. While you’re navigating the emotional journey of losing a loved one, you’re also faced with decisions about managing inherited real estate. If you’re considering selling an inherited home in Chicago, Ilinois, it’s natural to wonder about the tax implications. Fortunately, U.S. tax laws are structured to ease this process. Thanks to the “stepped-up basis” provision, the property’s value is adjusted to its fair market value at the time of inheritance, which can significantly reduce capital gains taxes when you sell . This means that selling your inherited property might be more financially advantageous than you initially thought. If you’re looking to sell your inherited house quickly and efficiently, understanding these tax benefits can help you make informed decisions and potentially maximize your returns.

Tax Consequences when selling a house I inherited in Chicago, Ilinois

Calculation of Basis

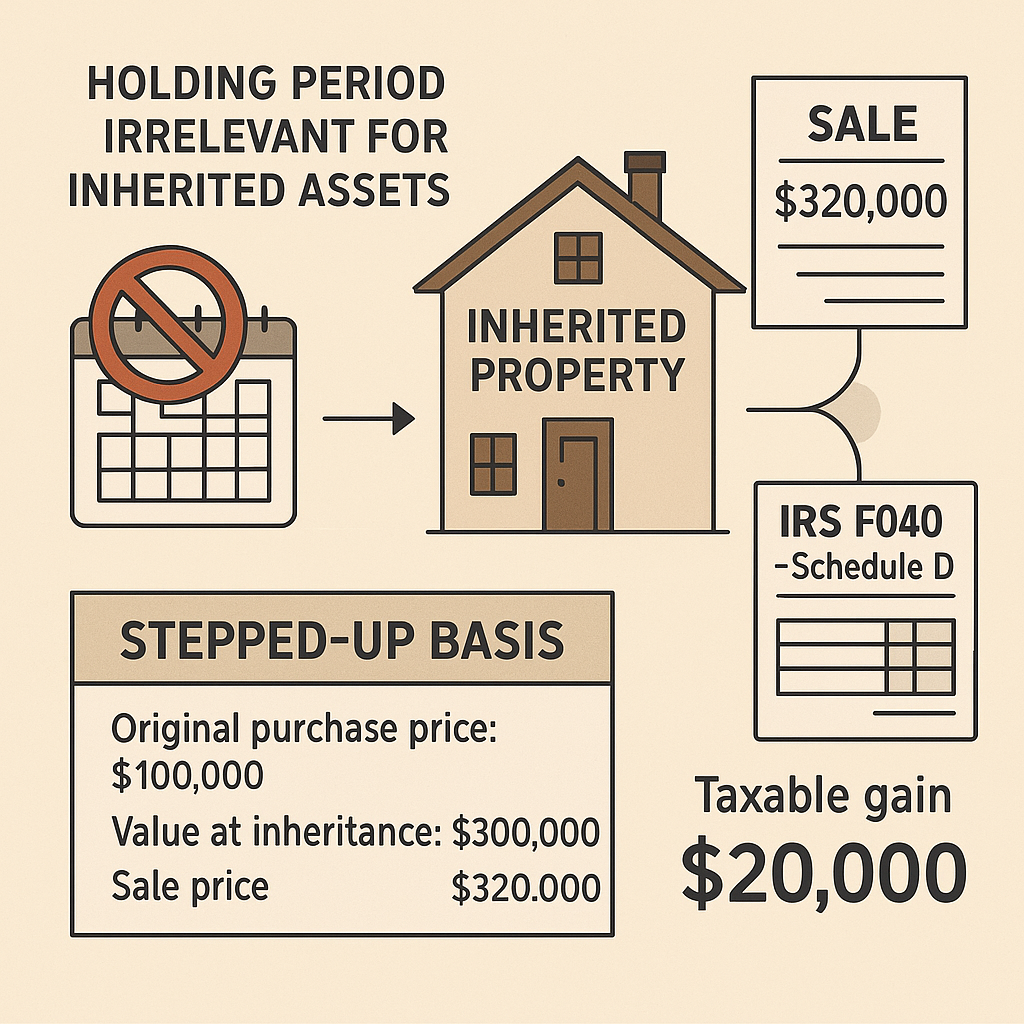

In order to determine how you’ll be taxed after you inherit a home, you need to know how the cost basis of the property is calculated. Basis, in this case, refers to the asset value for purpose of the calculation of capital gains, along other income taxes. When a person dies, the value or basis of their property in Chicago is increased to the market value at the time of their death. This is called a “stepped-up basis”. For instance, if a person purchased a home 20 years ago for $25,000 and it was worth $100,000 at the time of their death, that property would be valued at the latter amount ($100,000) for the purpose of calculating capital gains. This is a huge benefit from the government to those that inherit property. And this rule applies across the board for any heir, you don’t need to pay a fancy accountant to find obscure tax laws for you.

Taxation of Gains/Losses

Capital gains or losses refer to the money you earn from selling property that you use for either personal or investment purposes. Such use can be houses, furniture and lots more things. If you decide to sell an inherited home in Chicago, the income that is made from the sale is regarded as capital gain or loss for the purpose of income tax for that year. When you sell inherited property, the IRS automatically classifies any profit as a long-term capital gain, regardless of how long you’ve held the asset. This classification is advantageous because long-term capital gains are taxed at lower rates—0%, 15%, or 20%—depending on your income bracket . Plus, your new stepped-up basis on the inherited house results in a lower taxable gain when the property is sold, as you’re only taxed on the appreciation occurring after the date of inheritance .

Reporting the sale

Upon selling an inherited home, you have to report the money earned to the IRS for the income tax purposes. You should need to calculate your capital gain or loss. This is done by subtracting the cost basis from the sale amount, as well as subtracting any costs associated with the sale, ie title insurance, 6% realtor commissions, recording fees, etc. You would then report that amount to the IRS on your next tax return.

Having an inherited home can be stressful given the fact that you have a new property to take care of plus having to pay property taxes and monthly expenses for it at the same time as long as you own it… You should go through the probate process in Chicago as the first step to selling the property. We discuss in a previous article. The court will then authorize you or another family member or friend to become the administrator or executor of the estate to proceed as you wish with the property. If there are any other individuals or family members involved in the inheritance, you should first discuss and agree with each other on that decision. You can then file a petition requesting the court to allow you to sell the property. Braddock Investment Group Inc doesn’t charge any Realtor fees when we buy inherited houses in Chicago plus we pay for all the closing costs, resulting in you pocketing way more money than using a real estate agent.

It is important to consider how much tax you are going to pay. And remember this will be paid against the capital gains or losses resulting from the sale of the house. You can call Braddock Investment Group Inc now at (312) 564-4058 to undertake a smooth and legitimate sale of your home. We are local here in Chicago Ilinois and we know the market here better than anyone else. If you are still asking yourself what are the tax consequences when selling a house I inherited in Chicago, then we would be happy to discuss it with you in more detail. Plus we’ve worked with quite a few attorneys that handle probate estates and the probate process. We can always refer you to one of them in our network.

Selling an inherited house can relieve you of quite a burden. In addition to that, selling the property to an investor is a quick and easy process. Contact us for inquiries on how to go about things when selling your home in Chicago and we will be glad to guide you along.