Despite its well-intentioned goals of preserving affordable housing and preventing displacement, Chicago’s Northwest Housing Preservation Ordinance represents a misguided approach that will ultimately harm the very communities it aims to protect. While proponents argue the ordinance will safeguard naturally occurring affordable housing in rapidly gentrifying neighborhoods, evidence from Chicago and similar policies nationwide demonstrates that this type of regulatory intervention creates more problems than it solves.

*UPDATE!

Major Victory: Two Chicago Wards Exit Northwest Housing Preservation Ordinance

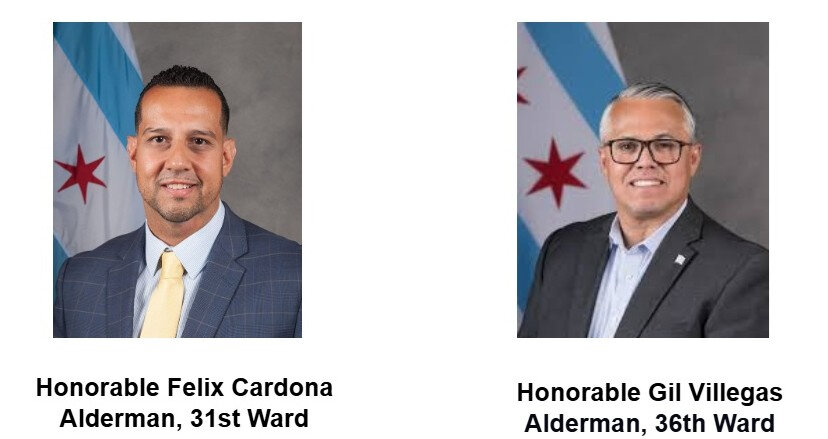

Chicago landlord and resident communities on the north side achieved a significant victory in last week when Aldermen Felix Cardona Jr. (31st ward) and Gilbert Villegas (36th ward) successfully removed their wards from the Chicago Northwest Housing Preservation Ordinance. This breakthrough represents a major win for Chicago landlord opposition to housing ordinance efforts.

Relief from Restrictive Regulations

The northwest housing ordinance had severely impacted property transactions, with the 2025 ordinance impacts on sales creating months-long delays that the city was inadequately staffed to handle. Many burnt out landlords struggled with complex tenant right-of-first-refusal requirements that complicated closings and severely limited landlord options for non-paying tenants in Illinois.

Under the original framework, renters could match sale offers within strict timelines, creating opportunities for problem tenants to exploit system complexities while legitimate property owners faced overwhelming regulatory obstacles that city departments couldn’t properly manage.

Immediate Benefits

The opt-out eliminates transaction delays and restores normal market processes. Chicago landlord and real estate professionals can now operate in these two wards efficiently without ordinance-related complications affecting their properties or transactions.

Alderman Villegas noted the Chicago Northwest Housing Preservation Ordinance was “flawed from the beginning” due to inadequate stakeholder input during drafting.

Both aldermen remain open to future participation if the northwest housing ordinance addresses current concerns through proper collaboration. The pilot program expires December 2029, providing opportunity for comprehensive evaluation and potential improvements.

Hemlane recently highlighted Braddock Investment Group as a leading voice on how Chicago’s new housing ordinance is reshaping the market — and what smart investors are doing to adapt.

The Ordinance’s Ambitious but Flawed Framework

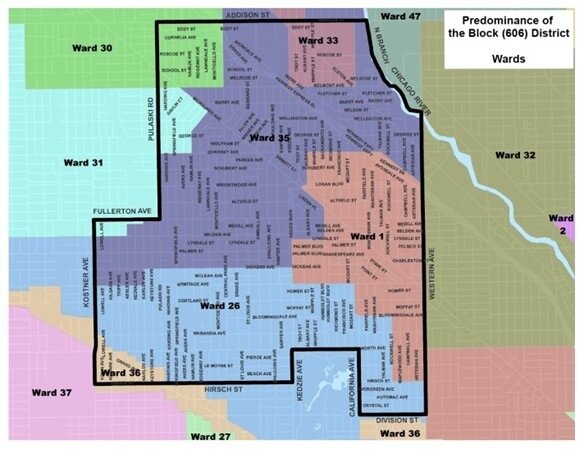

The Northwest Housing Preservation Ordinance, passed by the Chicago City Council in September 2024 and implemented in March 2025, applies to a six-square-mile area encompassing Logan Square, Avondale, Hermosa, Humboldt Park, West Town, and portions of Pilsen. The ordinance establishes two primary mechanisms: dramatically increased demolition fees and tenant right of first refusal provisions that grant renters unprecedented control over property sales.

Sales Timeline Comparison Under New Ordinance

Timeline visualization showing the extended property sale process under the new ordinance compared to traditional sales timelines

Under the new framework, demolition surcharges have quadrupled from $5,000 per unit and $15,000 per building to $20,000 per unit and $60,000 per building. More controversially, the ordinance requires property owners to provide tenants with 60 to 90 days advance notice before listing rental properties and grants tenants up to 120 additional days to match any accepted offer. This process can extend property sales by up to nine months, creating substantial delays and uncertainty for property owners.

Growing Political Opposition: Aldermen Withdraw Support

The political landscape surrounding the ordinance has shifted dramatically since its passage. Two aldermen who initially voted for the ordinance—Alderman Felix Cardona of the 31st Ward and Alderman Gil Villegas of the 36th Ward—have now introduced amendments to withdraw their wards from the ordinance coverage area. This represents a significant reversal from elected officials who witnessed firsthand the ordinance’s implementation challenges.

The Aldermen Who Have Withdrawn Their Support of the Ordinance

“It’s not working,” Cardona said, noting the ordinance has created delays around property sales. At least four Avondale property owners have complained that the tenant-first rules slow their ability to retire or cash out of their appreciated properties. “You’re messing with their retirement,” he explained.

Villegas raised concerns about legal ambiguity in the ordinance’s language and said snags it created for mortgages and title insurance suggest city attorneys didn’t fully vet the measure before its rollout. “It did not get enough attention,” he stated. The full ordinance applies to roughly 6 square miles, with about 20 percent falling in the two aldermen’s wards. They argue the implementation challenges in their neighborhoods point to larger systemic flaws.

This growing opposition reflects real-world experience with the ordinance’s harmful effects on property owners and the broader housing market.

How Real Estate Owners and Investors Are Adapting to Chicago’s New Housing Ordinance

Real estate professionals and property owners have been forced to adapt to the ordinance’s complex requirements through various strategies, though many are expressing serious concerns about its long-term viability.

Brie Schmidt Zdravkovic, managing broker and owner of Second City Real Estate, draws on her 13 years as a Chicago landlord to voice serious concerns about the ordinance. She argues that the policy reflects a fundamental disconnect from how real estate transactions and small businesses actually operate. Schmidt Zdravkovic emphasizes that the new rules are especially burdensome for owner-occupants—particularly those with owner-occupied financing—who depend on flexibility to manage their properties and finances.

“This ordinance shows a lack of practical understanding of real estate transactions and basic business principles. It’s especially punishing for owner-occupants and small landlords who rely on flexibility,” she cautions.

Property owners are implementing several adaptation strategies:

Extended Transaction Planning: Owners must now factor in potential nine-month delays when planning property sales, which creates challenges for those with mortgage maturities or loan covenants that may be violated by extended holding periods. (See chart above)

Enhanced Legal Compliance: Real estate attorneys such as Bob Floss Jr.—co-chair of the Chicago Bar Association’s residential real estate committee—have taken on the critical task of guiding property owners through the ordinance’s labyrinth of rules. Floss has highlighted the sheer number of gray areas and enforcement hurdles that now confront both sides of a transaction, warning that the ordinance’s complexity has introduced a new level of risk.

“With so many ambiguities and moving parts, this ordinance has turned the process into a legal minefield for both sellers and buyers,” Floss cautions.

Financial Restructuring: The Neighborhood Building Owners Alliance (NBOA) reports that property owners are having to make up for reduced building values caused by the ordinance through increased rents, as “owners will have to make up that loss of value with increased rents”.

Investment Reallocation: Many investors are simply avoiding the affected areas altogether. As one industry expert noted, “This ordinance makes it harder to invest in NOAH [Naturally Occurring Affordable Housing], it will make affordable housing scarce. Scarcity leads to increased rents”.

Record Keeping Requirements: Owners must now maintain detailed records for three years including the name, address, and phone number of all current property owners; the property address; the unit count and number of bedrooms and bathrooms in each unit; asking price; a statement of intent to sell; and a summary of tenant rights.

Mortgage and Banking Challenges: Property owners are experiencing difficulties with mortgage covenants and loan maturities due to the extended holding periods required by the ordinance. This creates additional financial stress that ultimately gets passed on to tenants through higher rents or deferred maintenance.

Major Ambiguities in Chicago’s Northwest Housing Preservation Ordinance

Legal Gaps

Confusion Continues: What Chicago’s Housing Ordinance Doesn’t Address

The ordinance’s implementation has revealed significant ambiguities that create ongoing challenges for property owners, tenants, and legal professionals. Luke Blahnik, a real estate expert who has analyzed the ordinance extensively, has documented numerous practical challenges with the policy’s implementation.

Financial Disclosure Requirements: The ordinance requires property owners to share detailed financial records, including rent rolls, vacancy rates, and income statements, not just with tenants but also with any third parties to whom tenants may assign their rights9. However, the scope and format of these disclosures remain poorly defined, creating compliance uncertainty.

Tenant Association Formation: While the ordinance allows tenants to form associations to collectively purchase buildings, the specific legal requirements and liability structures for these associations remain unclear. This ambiguity makes it difficult for both tenants and property owners to understand their rights and obligations.

Mortgage and Title Insurance Issues: Villegas specifically cited concerns about how the ordinance interferes with normal lending practices and title insurance requirements. Banks and mortgage companies must now factor in significant additional delays and uncertainties, but the legal implications for existing loans remain poorly understood.

Assignment Rights: The ordinance allows tenants to assign their purchase rights to third parties, but the legal parameters and restrictions on these assignments remain vague. This creates potential for abuse and manipulation that the ordinance’s drafters may not have anticipated.

Enforcement Mechanisms: The Chicago Department of Housing oversees compliance, but the specific penalties for violations and enforcement procedures have not been clearly established. This creates uncertainty about what happens when parties fail to meet the ordinance’s complex timeline requirements.

Financial Qualification Requirements: While the amended ordinance requires tenants to provide pre-approval from a lender for buildings with four or fewer units or a letter of intent from a lender or community organization for five or more units, the specific standards and verification processes remain unclear.

Right of First Refusal Waiver Process: The updated language allows sellers to ask tenants if they plan to waive their right of first refusal, but the specific procedures and timing for this process lack clarity.

Property Coverage Ambiguity: The ordinance impacts “virtually every type of housing, including condos, single-family homes, mixed-use properties, and even larger apartment buildings”, but the specific application to different property types remains poorly defined.

The Domino Effect: How Chicago’s Housing Ordinance Could Go Citywide

The ordinance’s potential for citywide expansion represents a significant concern for Chicago landlords, even those currently outside the affected area. The policy was explicitly designed as a pilot program with expansion possibilities built into its framework.

Expansion Precedent: The ordinance builds off two programs introduced in 2021 that protect homes along The 606 and in Pilsen, effectively making permanent those programs and expanding their coverage area. This demonstrates the city’s willingness to expand successful pilot programs. The district has already been expanded from an area of 1.7 square miles to 6 square miles.

Aldermanic Prerogative: The ordinance passed through “aldermanic prerogative,” which means that every alderman has the absolute right to make zoning and building decisions for their ward. As Brie Schmidt Zdravkovic noted, “this could very well get away from us and be everyone’s problem” if other aldermen decide to implement similar policies in their wards.

Stated Expansion Goals: Advocates of the ordinance are clear about their ambitions for broader impact, viewing it as a blueprint for addressing gentrification citywide. As Alderman Jessie Fuentes put it, the ordinance “can serve as a model for how to fight gentrification throughout the city.”

Historical Pattern of Expansion: Chicago has a documented history of expanding pilot programs that show perceived success. The current ordinance was introduced by six aldermen representing different wards, suggesting broader political support for similar measures.

Other Proposed Ordinances: Chicago has several other housing-related ordinances under consideration that could complement or expand upon the Northwest Housing Preservation Ordinance’s approach. The city is actively exploring various anti-displacement strategies that could be applied more broadly.

Unique Aldermanic Power Structure: Chicago’s aldermanic prerogative system gives individual aldermen extraordinary control over their wards, making it easier for similar ordinances to be implemented without citywide debate. This system is unique among major American cities and has been criticized for maintaining segregation and blocking development.

Important Discussion for All Chicago & Cook County Landlords: As Brie Schmidt Zdravkovic emphasized, “this is not a problem that is specific to just landlords and buyers and sellers in these neighborhoods—this is a whole Chicago landlord problem”. Even landlords outside the current ordinance area need to understand its implications because similar policies could spread throughout the city through aldermanic prerogative. The perceived success could lead to other municipalities adopting similar policies.

Political Momentum: The ordinance was passed very quickly through the City Council within days and became effective March 1, 2025, without meaningful input from the public or interactions with building and landlord associations. This rapid implementation process could be replicated in other wards.

Economic Theory Contradicts the Ordinance’s Logic

The fundamental flaw in the Northwest Housing Preservation Ordinance lies in its misunderstanding of basic housing economics. By artificially constraining the ability to buy, sell, and develop property, the ordinance will reduce housing supply and increase costs—the opposite of its stated intentions.

Research consistently demonstrates that increasing housing supply is the most effective way to improve affordability. The ordinance, however, actively discourages new investment in the affected neighborhoods by creating regulatory uncertainty and additional compliance costs. Property owners facing potential nine-month delays and complex bureaucratic requirements will naturally seek investment opportunities in less regulated markets.

Lessons from Failed Policies Nationwide

Chicago’s ordinance mirrors tenant opportunity to purchase acts (TOPA) implemented in other cities, with similarly disappointing results. Washington, D.C.’s TOPA, the nation’s oldest such law dating to 1980, provides a cautionary tale of unintended consequences.

Despite four decades of operation, D.C.’s TOPA has not solved the city’s affordable housing crisis. Instead, it has created a complex bureaucracy that often fails to protect tenants while imposing significant costs on property owners.

Even more tellingly, cities that have attempted similar policies have encountered significant resistance. Richmond, California’s city council voted unanimously to halt its TOPA ordinance in November 2019 after overwhelming community opposition emerged as residents scrutinized the policy’s harmful effects.

The Demolition Fee Debacle

The ordinance’s dramatic increase in demolition fees represents particularly counterproductive policy. While supporters argue these fees will preserve existing housing stock, the economic reality is more complex. The $60,000 fee for demolishing a building effectively creates a government-imposed tax that will be passed on to consumers.

This demolition tax particularly harms small property owners who may need to redevelop aging buildings that have reached the end of their useful lifecycle. Instead of preserving affordable housing, these fees will make housing more expensive while discouraging necessary improvements and modernization.

Impact on Naturally Occurring Affordable Housing Providers

Chicago owes 70% of its affordable housing stock to independent property owners—often family-run businesses that invest in and maintain rental properties at affordable rates without government subsidies. The ordinance creates significant disincentives for these crucial housing providers to continue their operations.

Unprecedented Financial Disclosure Requirements Under Chicago’s Housing Ordinance

Complete tenant payment records

Historical occupancy data

12-month financial performance

Unit counts, prices, owner information

The requirements for detailed financial disclosures represent an unprecedented intrusion into private business operations. These disclosure requirements must be shared not just with tenants, but also with any third parties to whom tenants may assign their rights, raising serious privacy and competitive concerns for property owners.

The False Promise of Tenant Ownership

Proponents tout the ordinance’s provision allowing tenants to purchase their buildings as a pathway to homeownership. However, this promise proves largely illusory upon closer examination. Research on similar programs demonstrates that tenant purchases of buildings under TOPA programs are extremely rare.

Luke Blahnik notes that the practical challenges of tenant ownership are substantial. Tenants must not only secure financing for entire buildings but also manage complex property operations, maintenance, and compliance requirements. Most renters lack the financial resources, credit history, or expertise necessary for such undertakings.

Even when tenants do attempt to exercise their purchase rights, the ordinance’s 30-year affordability covenant requirement severely limits their future options. Properties encumbered with such restrictions are worth hundreds of thousands of dollars less than unrestricted properties, effectively trapping tenant-owners in arrangements they may later regret.

Market Distortions and Unintended Consequences

The ordinance creates significant market distortions that will ultimately harm housing affordability. By imposing artificial delays and costs on property transactions, the policy reduces market efficiency and discourages beneficial investment in housing stock.

Bob Floss Jr. has documented the ordinance’s complexity and potential for abuse through his extensive legal analysis. His work reveals numerous ambiguities and enforcement challenges that create legal uncertainty for property owners and tenants alike.

Property owners facing potential 210-day delays between deciding to sell and actually closing on a sale may violate mortgage covenants or loan maturities. This creates additional financial stress that ultimately gets passed on to tenants through higher rents or deferred maintenance.

Investment Flight and Neighborhood Decline

Perhaps the most damaging long-term consequence of the ordinance will be the flight of responsible investment capital from the affected neighborhoods. Property investors, faced with increased regulatory uncertainty, extended transaction timelines, and reduced control over their assets, will naturally seek opportunities in less regulated markets.

This investment flight will manifest in several ways:

- Reduced property values as buyers discount the additional regulatory risks

- Deferred maintenance as owners become reluctant to invest in improvements they may not be able to recoup

- Decreased new construction as developers avoid the regulatory complexity

- Gradual deterioration of housing stock as responsible owners sell to less scrupulous operators

Alternative Solutions That Actually Work

Rather than imposing complex regulatory schemes that distort housing markets, Chicago should focus on policies that increase housing supply and reduce regulatory barriers. Successful examples from other jurisdictions demonstrate the effectiveness of market-oriented approaches:

Zoning Reform: Eliminating exclusionary zoning that prevents multi-family housing development would allow market forces to create more affordable options. The ordinance does include some positive zoning changes, allowing two-flats as of right on all standard size parcels zoned RS-3.

Streamlined Permitting: Reducing the time and cost required to obtain building permits encourages new construction and rehabilitation of existing properties. Faster approval processes reduce development costs, which translates into lower housing costs for consumers.

Tax Incentives: Providing tax incentives for property owners who maintain affordable rents or improve housing quality creates positive incentives rather than punitive regulations.

Industry Expert Perspectives

The real estate and housing industry has consistently opposed the ordinance based on practical experience with housing markets. The Neighborhood Building Owners Alliance (NBOA), representing multiple real estate organizations, has developed both legislative and legal strategies to fight the ordinance’s implementation.

Michael Glasser, president of NBOA, characterizes the ordinance as “an attack on apartment owners’ private property rights” that “could cost owners money and loss of control over their property”. This concern reflects the broader industry understanding that such regulations undermine property rights and market efficiency.

The Chicago Association of Realtors has also opposed the ordinance, arguing that it creates unnecessary complexity and delays in real estate transactions. Their opposition led to amendments that slightly improved the ordinance but did not address its fundamental flaws.

The Path Forward

Chicago faces genuine affordable housing challenges that require thoughtful policy responses. However, the Northwest Housing Preservation Ordinance represents exactly the wrong approach—one that will exacerbate the problems it aims to solve.

The ordinance’s sunset clause, requiring expiration on December 31, 2029, provides an opportunity for policymakers to acknowledge their mistake and pursue more effective alternatives. However, waiting five years to correct a flawed policy will impose unnecessary costs on both property owners and tenants in the affected neighborhoods.

The growing opposition from Aldermen Cardona and Villegas, who initially supported the ordinance, demonstrates that even its proponents are recognizing its fundamental flaws when confronted with real-world implementation challenges.

Map of the Chicago Northwest Side Housing Preservation Ordinance

Conclusion

While the Northwest Housing Preservation Ordinance emerged from legitimate concerns about gentrification and displacement, its regulatory approach will ultimately harm the communities it seeks to protect. By constraining housing supply, discouraging investment, and creating market distortions, the ordinance will make housing less affordable and reduce opportunities for residents to build wealth through property ownership.

The experiences of other cities with similar policies provide clear warnings about the unintended consequences of such regulatory interventions. Rather than continuing down this failed path, Chicago should embrace market-oriented reforms that increase housing supply and reduce regulatory barriers.

The goal of preserving affordable housing in gentrifying neighborhoods is admirable, but the means chosen to achieve this goal are counterproductive. Effective housing policy requires understanding and working with market forces, not against them. Until policymakers recognize this fundamental truth, well-intentioned but misguided ordinances like the Northwest Housing Preservation Ordinance will continue to make housing problems worse rather than better.

For Chicago landlords citywide, the ordinance represents a critical test case. If similar policies spread through aldermanic prerogative to other wards, the entire city’s rental housing market could face similar disruptions. The time to engage with this issue is now, before these harmful policies metastasize throughout Chicago’s housing market.

Last updated: July 30, 2025