Yes, you can still save your home from foreclosure—even if the auction is next week. If you’re behind on mortgage payments in Chicago, you need to know the fastest, most reliable ways to stop foreclosure immediately before it’s too late.

Every month, hundreds of Chicago homeowners face the same crisis you’re facing right now. The difference between those who lose everything and those who walk away with cash? Taking the right action at the right time. Braddock Investment Group has helped Illinois families avoid foreclosure since 2009, and we know exactly which strategies work.

This guide reveals your real options—not false hope, but practical solutions that can stop foreclosure Chicago proceedings in as little as 7 days. Whether you’re just behind on payments or facing an imminent sheriff’s sale, you’ll discover which preforeclosure home sale options actually work.

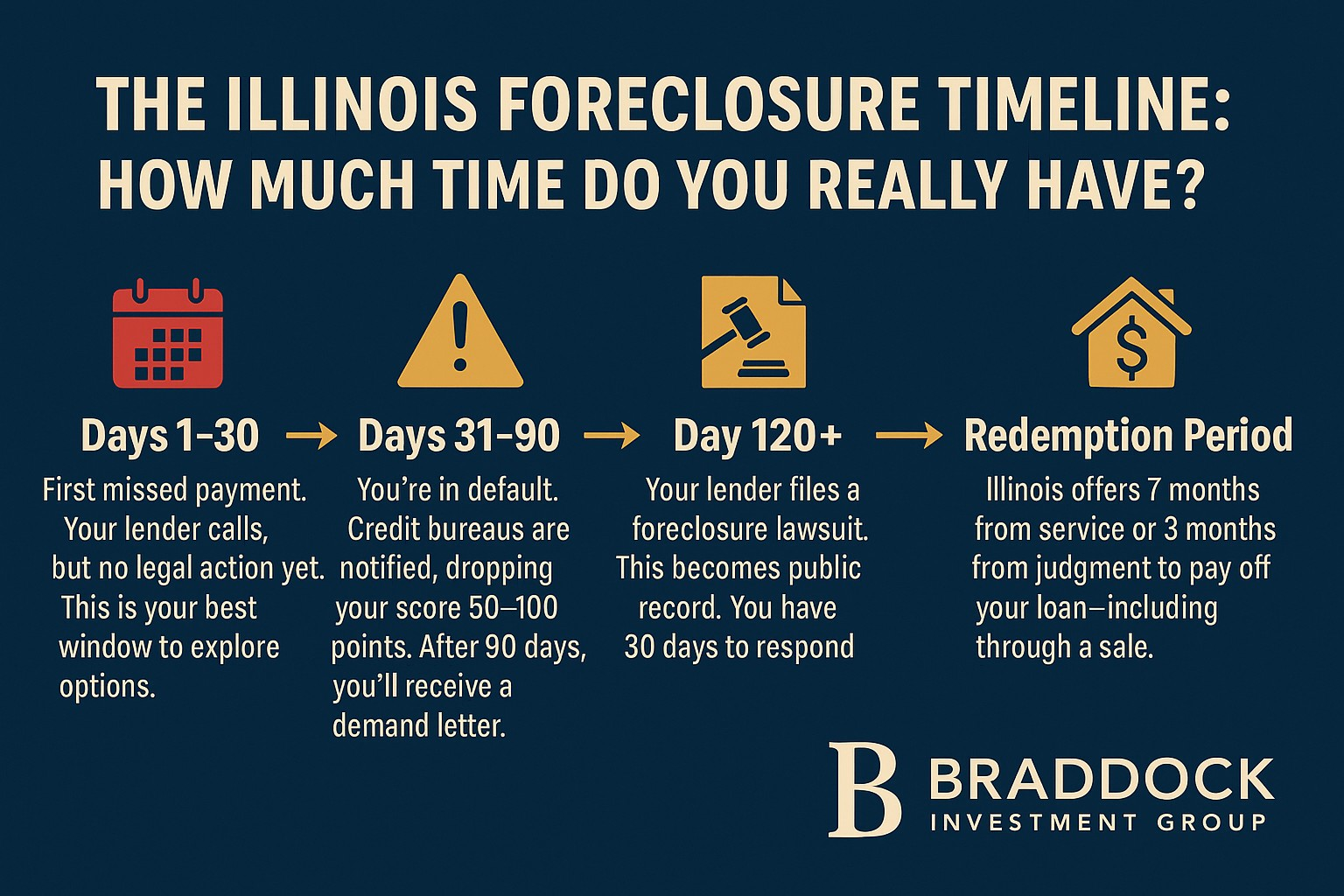

The Illinois Foreclosure Timeline: How Much Time Do You Really Have?

Understanding your timeline is crucial. Illinois uses judicial foreclosure, which means your lender must go through the courts—giving you more time than many states, but that clock is always ticking.

Days 1-30: First missed payment. Your lender calls, but no legal action yet. This is your best window to explore options.

Days 31-90: You’re in default. Credit bureaus are notified, dropping your score 50-100 points. After 90 days, you’ll receive a demand letter.

Day 120+: Your lender files a foreclosure lawsuit. This becomes public record. You have 30 days to respond.

Months 6-9: Without action, the court issues a judgment. Sheriff’s sale is scheduled 3-4 months out.

Redemption Period: Illinois offers 7 months from service or 3 months from judgment to pay off your loan—including through a sale.

The Critical Truth: You can sell at ANY point before the sheriff’s sale completes. But the sooner you act, the more options you have and the better your outcome.

Don’t wait until it’s too late. Learn how our process works or call (312) 564-4058 to discuss your timeline.

Your Real Options to Avoid Foreclosure

Option 1: Traditional Sale (60-90 Days)

Too slow for most foreclosure situations. Requires repairs, showings, and buyer financing approval. Plus, you’ll lose 6% to realtor commissions and risk the sale falling through.

Option 2: Loan Modification (3-6 Months)

Banks approve less than half of applications. Even if approved, many homeowners can’t maintain the new payments. Meanwhile, foreclosure continues during the application process.

Option 3: Short Sale (3-9 Months)

Requires bank approval, damages credit almost as much as foreclosure, and leaves you with nothing. These preforeclosure home sale options often fail when time is critical.

Option 4: Bankruptcy (Temporary Fix)

Chapter 13 can temporarily halt proceedings but requires payment plans many can’t maintain. It destroys credit for 7-10 years and rarely saves homes long-term.

Option 5: Sell for Cash (7-10 Days)

The fastest solution. Cash buyers like Braddock Investment Group can close quickly, stop foreclosure Chicago proceedings immediately, and often leave you with money in your pocket. No repairs needed, no realtor fees, and no financing delays.

When you need ways to stop foreclosure immediately, cash sales offer the best combination of speed, certainty, and financial outcome.

Why Chicago Homeowners Choose Braddock Investment Group

|

There are a lot of “we buy houses” companies out there. Here’s what sets Braddock apart for Chicago-area homeowners in foreclosure:

If you’d rather skip the showings, repairs, and uncertainty of a traditional sale, our cash offer process gives you a simple, private alternative. |

|

How We Help Stop Foreclosure in 7 Days

Our process is simple, transparent, and designed to avoid foreclosure quickly:

Day 1: Free Consultation

Call (312) 564-4058. We’ll discuss your situation, timeline, and options. No judgment, just solutions.

Day 2: Fair Cash Offer

Within 24 hours, you’ll receive a written offer based on current Chicago market values. See what other sellers say about our offers.

Day 3: You Accept on Your Terms

Choose your closing date. Need time to pack? No problem. Want to close tomorrow? We can do that too.

Days 4-6: We Handle Everything

We contact your lender, handle paperwork, and coordinate with title companies. You don’t pay anything—we cover all closing costs.

Day 7: Close and Move Forward

Walk in facing foreclosure, walk out with cash and a fresh start. No more collector calls, no sheriff at your door.

Real Chicago Success Stories

Inherited Property Crisis: Maria inherited a house with a $180,000 mortgage she couldn’t afford. Facing foreclosure, she called us on Wednesday. By the following Wednesday, she’d closed for $195,000, paid off the mortgage, and walked away with $15,000.

Job Loss Emergency: David lost his job and fell five months behind. With three weeks until the sheriff’s sale, traditional selling wasn’t an option. We closed in 10 days, giving him funds to relocate and start fresh.

Divorce Situation: Jennifer couldn’t afford the mortgage alone after divorce. We bought her house as-is in seven days, helping her avoid foreclosure and begin her new chapter.

Your story can have a positive ending too. Contact us today to explore your options.

Common Foreclosure Myths That Cost Chicago Homeowners Their Homes

Myth: “Once foreclosure starts, it’s too late to sell.”

Truth: You can sell right up to the sheriff’s sale. We’ve helped homeowners stop foreclosure with just days to spare.

Myth: “I need to fix my house first.”

Truth: We buy houses as-is. No repairs, no cleaning, no stress. This is one of the key advantages of cash preforeclosure home sale options.

Myth: “Bankruptcy is my only choice.”

Truth: Bankruptcy rarely saves homes and destroys credit for a decade. Cash sales offer better outcomes without the long-term damage.

Myth: “Banks will work with me.”

Truth: Banks deny most modification requests. Don’t gamble your home on their mercy when proven alternatives exist.

Everything You Need to Know About Selling Your House in Foreclosure: Chicago FAQs

Can I really stop foreclosure Chicago proceedings this late?

Yes, Illinois law allows sales until the auction completes. The key is working with cash buyers who can close quickly. Even with days left, there are still ways to stop foreclosure immediately.

What if I owe more than my house is worth?

This is called being “underwater” or “upside down” on your mortgage. If our offer doesn’t cover what you owe, you have options. Sometimes we can negotiate with your lender for a payoff amount less than what’s owed. Other times, bringing a small amount to closing is better than losing everything to foreclosure. Every situation is unique—call us at (312) 564-4058 to discuss your specific numbers.

How is this different from a short sale?

Short sales take months, require bank approval, and often fail. Cash sales close in days without needing your lender’s permission—a much more reliable way to avoid foreclosure.

What happens to my credit?

Selling before foreclosure can save your credit score from devastating damage. While late payments may have already affected your score, avoiding foreclosure prevents the 200-400 point drop that comes with it.

Will I have to pay taxes on a foreclosure sale?

When you sell to avoid foreclosure (rather than going through foreclosure), it’s treated as a normal home sale for tax purposes. Depending on how long you’ve lived in the home and other factors, you might qualify for capital gains exclusions. We recommend consulting a tax professional, but avoiding foreclosure through a cash sale is typically much better for your tax situation than actual foreclosure.

Do I have to move immediately?

No, we work with your timeline. Some sellers need a week, others a month. Unlike foreclosure eviction, you’re in control.

What if my house is in terrible condition?

We mean it when we say “any condition.” We’ve bought fire-damaged properties in Englewood, flood-damaged homes in Des Plaines, and houses with massive foundation problems in Maywood. You don’t clean, repair, or even remove garbage. We handle everything.

How do I know this is legitimate?

Braddock Investment Group has operated in Illinois since 2009 with hundreds of successful transactions. Learn more about our company and check our Better Business Bureau rating.

What areas of Chicago do you cover?

All of them! From the North Side (Rogers Park, Uptown, Lincoln Square) to the South Side (Hyde Park, Bronzeville, Beverly), from the West Side (Austin, Garfield Park, Humboldt Park) to downtown (Loop, River North, Streeterville). We also buy throughout the suburbs including Cook, DuPage, Lake, Will, Kane, and McHenry counties.

What if I’ve already filed bankruptcy?

You can still sell, but you’ll need bankruptcy court approval. We work with bankruptcy attorneys regularly and understand the process. The trustee usually approves sales that pay off debts. Call us at (312) 564-4058 and we’ll coordinate with your attorney.

Can you help if I have multiple mortgages or liens?

Yes. Whether you have a second mortgage, HELOC, tax liens, mechanic’s liens, or HOA liens in communities like Hoffman Estates or Bolingbrook, we handle the complexity. We negotiate with all parties and often structure deals that clear all debts.

What documents do I need to sell?

Less than you think! Basic documents include your ID, mortgage statements, and property deed. If you’re missing documents, we help you get them. Don’t let paperwork fears stop you from saving your home from foreclosure.

Your Action Plan: What to Do Right Now

Step 1: Stop panicking and start acting. Fear and embarrassment keep too many homeowners paralyzed while their options disappear.

Step 2: Gather your information. Find your mortgage statements, foreclosure notices, and court documents. Know your payoff amount and deadlines.

Step 3: Call us today. Don’t wait another day. Contact Braddock Investment Group at (312) 564-4058 for a free, no-pressure consultation.

Step 4: Get your cash offer. Within 24 hours, you’ll have a written offer and a clear path forward.

Step 5: Choose your future. Accept our offer and close in as little as 7 days, or explore other options with the knowledge you’ve gained.

The difference between losing everything and walking away with cash often comes down to taking action today instead of tomorrow. Visit our FAQ for more details, or better yet, call us now.

The Clock Is Ticking on Your Chicago Home

You now know your options. You understand the timeline. You’ve seen how others successfully avoided foreclosure. The only question left: Will you act before it’s too late?

Every day you wait reduces your options and costs you money. While you’re reading this, other Chicago homeowners are getting cash offers and scheduling closings. They’re choosing action over anxiety, solutions over surrender.

Foreclosure doesn’t have to be your story’s ending. With the right help and immediate action, you can stop foreclosure Chicago proceedings, protect your credit, and often walk away with cash to start fresh.

Don’t wait another minute. Your home’s equity is disappearing.

Call Braddock Investment Group NOW at (312) 564-4058. Tell us you need help stopping foreclosure. We’ll take it from there—no judgment, just solutions. In 24 hours you could have an offer. In 7 days, you could be free from foreclosure forever.

Make the call that changes everything: (312) 564-4058