Falling behind on property taxes in Cook County, Illinois can feel overwhelming, especially with THE nation’s highest property tax rates. Whether you’re in Cicero, Skokie, Arlington Heights, or anywhere else in Cook County, understanding your options when facing delinquent property taxes could save your home and protect your equity. If you’re struggling with overdue property taxes, you’re not alone—and there are solutions available.

Quick Navigation: Jump to FAQ →

Understanding Delinquent Property Taxes in Cook County

In Cook County, property tax bills are among the highest in the nation, with an average effective rate of 2.01%—double the national average. When you cannot pay these taxes by their due date, they become “delinquent,” triggering a complex legal process that could ultimately result in losing your home.

Cook County’s property tax rates by location:

- Cook County average: 2.01%

- Arlington Heights: 2.15% (median annual bill: $7,370)

- Skokie: Approximately 2.02% (village portion only 5.6% of total bill)

- Cicero: Part of Cook County’s overall tax structure

Unlike other states, Illinois has a unique tax sale system where the county doesn’t directly foreclose on properties. Instead, Cook County auctions off the unpaid tax debt to private investors, known as “tax buyers,” who then have the right to eventually take ownership of the property if taxes aren’t paid.

The Cook County Tax Sale Process: What You Need to Know

Current Status: 2025 Tax Sale Postponement

Cook County Treasurer Maria Pappas postponed the 2025 tax sale due to concerns over homeowners losing their homes and equity. This temporary pause provides breathing room for homeowners facing delinquency, but it doesn’t eliminate the underlying debt.

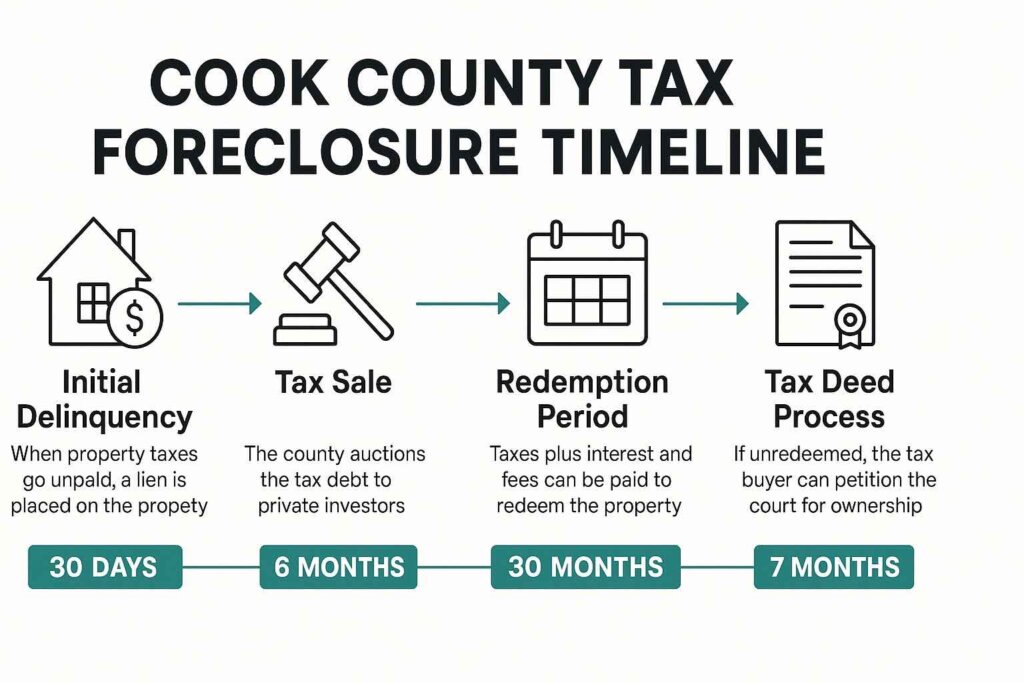

How Cook County Tax Sales Work

- Initial Delinquency: When property taxes go unpaid, a lien is placed on your property

- Tax Sale: The county auctions your tax debt to private investors

- Redemption Period: You have typically 30 months to pay back the taxes plus interest and fees

- Tax Deed Process: If unredeemed, the tax buyer can petition the court for property ownership

Critical Timeline for Cook County Properties:

- Residential properties (1-6 units): 30-month redemption period

- Commercial/Industrial properties: 12-month redemption period

- Notice requirements: Tax buyers must provide notice within 4.5 months of sale

Why Cook County’s System Is Particularly Challenging

Illinois remains the only state where homeowners can lose not just their homes but all accumulated equity when properties are lost to tax foreclosure. This means even if your home is worth $200,000 and you owe only $5,000 in back taxes, you could lose the entire value.

Shocking Cook County Statistics:

- More than 1,000 owner-occupied homes lost to tax foreclosure since 2019

- Collective home values: $108 million lost over just $2.3 million in tax debt

- Over half of foreclosed homes had initial tax debts of $1,600 or less

- Some homes were lost over debts as small as $200

Local Challenges in Cicero, Skokie, and Arlington Heights

Cicero: Dense Urban Challenges

Cicero, one of Cook County’s most densely populated suburbs, faces unique property tax challenges. The town’s aging housing stock and diverse population often struggle with the high effective property tax rates. Many residents are unaware of available exemptions or assistance programs.

Skokie: Stable but Expensive

While Skokie’s village portion represents only 5.6% of the total property tax bill (compared to 16% in 1990), residents still face high overall tax burdens. The average residential tax bill in Skokie was approximately $7,163, making delinquency a serious financial threat.

Arlington Heights: High-Value Properties at Risk

Arlington Heights has a 2.15% effective property tax rate with median annual bills of $7,370. High property values mean larger tax bills, and tax bills range from $4,065 (25th percentile) to $9,663 (75th percentile). Even brief financial hardships can lead to substantial tax debt.

When Selling Your Home Makes Sense

If you’re facing significant property tax debt in Cook County, selling your home before the situation worsens may be your best financial decision. Here’s why:

Protecting Your Equity

Unlike the current Cook County system where tax buyers can claim all equity, selling proactively allows you to:

- Pay off tax debt from sale proceeds

- Keep remaining equity for your fresh start

- Avoid additional penalties and legal fees

- Control the timing and terms of your sale

Realistic Timeline Considerations

With Cook County’s 30-month redemption period for residential properties, you have time to explore options. However, interest and penalties continue accruing, making early action beneficial.

Traditional vs. Cash Home Sales for Tax-Delinquent Properties

Traditional Real Estate Sales Challenges

- Lengthy process (3-6 months average)

- Buyer financing complications due to tax liens

- Required repairs and staging costs

- Real estate commissions (typically 6%)

- Risk of deals falling through due to lien issues

Cash Sale Advantages with Braddock Investment Group

When facing property tax delinquency, working with an experienced cash buyer like Braddock Investment Group offers distinct advantages:

✓ Speed: Close in as little as 7 days ✓ Simplicity: We handle lien payoffs at closing ✓ Condition: Buy properties as-is, no repairs needed ✓ Certainty: No financing contingencies or deal failures ✓ Cost: No commissions or closing costs to you

The Selling Process with Tax Liens in Cook County

Step-by-Step Process

- Debt Assessment: Determine exact amount owed through Cook County Clerk’s delinquent tax search

- Property Valuation: Assess current market value vs. tax debt

- Lien Payoff Coordination: Work with title company to ensure proper lien clearance

- Closing Process: Tax liens paid from sale proceeds before you receive your portion

Working with Experienced Buyers

Choose buyers familiar with Cook County’s unique tax system. Braddock Investment Group has extensive experience with:

- Cook County tax lien procedures

- Title company coordination

- Expedited closing processes

- Fair market value assessments

- Avoid foreclosure in Chicago

Cook County’s Proposed Reforms: What They Mean for You

Cook County Treasurer Maria Pappas and state legislators are pushing for reforms that would require surplus equity to be returned to homeowners. Proposed changes include:

- Public auctions after tax deed issuance

- Homeowner equity protection

- Minimum bid requirements equal to tax debt

- Constitutional compliance with 2023 Supreme Court ruling

However, these reforms were delayed in the 2025 legislative session, leaving the current problematic system in place.

Immediate Action Steps for Cook County Homeowners

If You’re Currently Behind on Taxes:

- Check Your Status: Use the Cook County Delinquent Property Tax Search

- Calculate Total Debt: Include penalties, interest, and potential legal fees

- Assess Your Options: Compare debt to property value

- Contact Professionals: Speak with experienced cash buyers or tax attorneys

- Act Quickly: Interest continues accruing during delays

If You’re Facing Financial Hardship:

Don’t wait until tax bills become delinquent. Contact Braddock Investment Group for a free, no-obligation consultation about your options.

Click Here to Find Out How it Works. Or Schedule Your Free Consultation – Call (312) 564-4058

Available Exemptions and Assistance in Cook County

Before considering a sale, explore available relief:

Cook County Property Tax Exemptions:

- General Homestead Exemption: $10,000 assessed value reduction

- Senior Citizens Exemption: $8,000 additional reduction (age 65+)

- Senior Citizens Assessment Freeze: Limits increases for qualifying seniors

- Veterans with Disabilities: Various exemptions available

- Persons with Disabilities: Additional exemptions

- Click Here to Check If You Qualify For Any Exemptions

Application Process:

Contact your local assessor’s office:

- Cicero: Town Assessor at (708) 656-3600

- Skokie: Niles Township Assessor at (847) 673-9300

- Arlington Heights: Wheeling Township Assessor

The Emotional Side: Making the Right Decision

Losing a family home to tax foreclosure is devastating, but holding onto a property you cannot afford creates ongoing stress and uncertainty. Many homeowners in Cicero, Skokie, and Arlington Heights have successfully transitioned to more manageable housing situations by selling proactively.

Consider selling if:

- Tax debt exceeds 10% of property value

- You’re facing additional financial hardships

- Property needs significant repairs

- You want to avoid foreclosure stress

- You need liquidity for other priorities

Success Stories: Cook County Homeowners Who Sold

“We inherited a property in Cicero with $12,000 in back taxes. Braddock Investment Group handled everything, paid off the liens, and we walked away with $45,000 to start fresh.” – Maria S., Cicero

“Arlington Heights property taxes were killing us after my husband’s job loss. BIG bought our house in 10 days, and we avoided foreclosure completely.” – Robert T., Arlington Heights

Moving Forward: Your Next Steps

Dealing with delinquent property taxes in Cook County doesn’t have to mean losing everything. Whether you’re in Cicero’s dense neighborhoods, Skokie’s established communities, or Arlington Heights’ suburban landscape, you have options. If you’re considering selling your house fast in Skokie, working with Arlington Heights cash home buyers, or need Cicero property solutions, we can help through our simple 3-step home buying process.

Ready to Explore Your Options?

Braddock Investment Group specializes in helping Cook County homeowners facing property tax challenges. We offer:

- Free property assessments

- No-obligation cash offers

- Quick closings (7-14 days)

- Professional lien handling

- Compassionate service during difficult times

Click Here or Call (312) 564-4058 for Your Free Consultation

Don’t let Cook County’s complex tax system cost you your home equity. Take control of your situation today and discover how selling for cash can provide the fresh start you need.

Frequently Asked Questions About Cook County Property Tax Liens

How long do I have to pay delinquent property taxes in Cook County?

In Cook County, residential properties typically have a 30-month redemption period from the tax sale date. However, interest and penalties continue accruing throughout this period.

Can I sell my house if there’s a property tax lien?

Yes, you can sell your house with a property tax lien. The lien must be satisfied at closing from the sale proceeds, but this is a standard process that experienced buyers handle routinely.

What happens if Cook County forecloses on my property for taxes?

Under the current Illinois system, if your property goes through tax foreclosure, you lose all equity in the home, even if it’s worth significantly more than the tax debt owed.

Are there assistance programs for Cook County property tax debt?

Cook County offers various exemptions including homestead, senior, and disability exemptions. Contact your local township assessor to determine eligibility.

How much does it cost to sell my house with tax liens?

When working with cash buyers like Braddock Investment Group, there are no real estate commissions or fees to you. The tax liens are paid from the sale proceeds at closing.

Can I negotiate with Cook County on my tax debt?

Cook County has limited flexibility on tax debt negotiations. However, you may qualify for exemptions or appeals if your property was incorrectly assessed.

What’s the difference between tax liens and tax foreclosure?

A tax lien is a claim against your property for unpaid taxes. Tax foreclosure is the legal process where ownership transfers to the tax buyer if the debt isn’t paid during the redemption period.

Why are Cook County property taxes so high?

Cook County has numerous taxing districts (schools, municipalities, parks, etc.) and faces significant budget pressures. The area also has high property values, contributing to large tax bills.

This article provides general information and should not be considered legal advice. Consult with qualified professionals regarding your specific situation.

![How to Sell Your [market_city] Home When Facing Delinquent Taxes or Property Tax Liens](https://image-cdn.carrot.com/uploads/sites/39968/2025/08/07.jpg)