Are you behind on mortgage payments and wondering, “Will I be giving my house back to the bank in Chicago?” You’re not alone, and there are better alternatives than foreclosure.

Cook County, Illinois has one of the highest foreclosure rates in the nation, with one in every 312 homes facing foreclosure proceedings. If you’re a Chicago homeowner facing financial difficulties, understanding your options before losing your home can save your credit score and financial future.

Understanding Chicago’s Foreclosure Crisis in Cook County

Cook County, home to Chicago and the third-largest metropolitan area in the United States, has experienced significant foreclosure activity in recent years. According to recent data, Cook County saw a 258% increase in foreclosure filings in the first half of 2022, ranking as the 20th highest foreclosure rate among more than 1,700 counties nationwide.

Key Chicago Foreclosure Statistics:

- Cook County had 7,265 housing units in foreclosure during the first half of 2022

- The county processes approximately 770 new foreclosure cases monthly

- Chicago completed 194 foreclosures (REOs) in January 2024 alone

- Illinois has one of the highest foreclosure rates nationally, with one in every 2,096 housing units receiving foreclosure filings

These numbers reflect the ongoing challenges facing Chicago homeowners in neighborhoods from Lincoln Park and Wicker Park to the South Side and beyond. Whether you’re dealing with a bungalow in Bridgeport, a condo in River North, or a multi-unit building in Logan Square, foreclosure can affect any property type in any Chicago neighborhood.

How the Foreclosure Process Works in Chicago and Illinois

The foreclosure process in Illinois is judicial, meaning it goes through the court system and typically takes 12-15 months to complete. Here’s what Chicago homeowners need to know:

Timeline of Illinois Foreclosure Process:

- 90+ Days Past Due: After missing three mortgage payments, your lender may file a foreclosure lawsuit

- Lis Pendens Filing: A formal notice of foreclosure is filed with the Cook County Clerk

- Court Proceedings: The case moves through Cook County’s judicial system

- Judgment: If the court rules in favor of the lender, a foreclosure judgment is entered

- Sheriff’s Sale: Your property is scheduled for public auction

- Redemption Period: You have additional time to reclaim your property by paying the full amount owed

Throughout this process, Cook County homeowners have opportunities to stop foreclosure through various legal and financial remedies. The key is taking action early, before the sheriff’s sale occurs.

The Devastating Impact of Foreclosure on Your Financial Future

Foreclosure doesn’t just mean losing your home—it creates long-lasting financial consequences that can affect Chicago families for years:

Credit Score Impact: Foreclosure can drop your credit score by 100-150 points, making it extremely difficult to:

- Qualify for future mortgages or rental apartments in competitive Chicago neighborhoods

- Obtain reasonable interest rates on loans or credit cards

- Pass employment background checks for certain positions

- Secure favorable insurance rates

Additional Financial Consequences:

- Deficiency judgments if your home sells for less than the mortgage balance

- Tax implications from forgiven debt

- Difficulty finding rental housing in desirable Chicago areas

- Potential wage garnishment in Illinois

- Years of rebuilding your credit history

Given Cook County’s competitive housing market, where the median home value is $255,500 and the typical household income is $67,886, protecting your credit is crucial for future housing opportunities.

Better Alternatives to Foreclosure in Chicago

Fortunately, Chicago homeowners have several proactive options that can minimize the long-term damage of financial hardship:

1. Deed in Lieu of Foreclosure

A deed in lieu of foreclosure allows you to voluntarily transfer ownership of your Chicago property to your lender, avoiding the formal foreclosure process. This option:

- Prevents foreclosure from appearing on your credit report

- Saves your lender the cost of lengthy court proceedings

- May allow you to negotiate move-out assistance or relocation funds

- Typically results in less severe credit impact than completed foreclosure

2. Short Sale

If your Chicago home is worth less than your mortgage balance, a short sale might be possible. This involves:

- Selling your property for less than the outstanding loan amount

- Obtaining lender approval for the reduced payoff

- Working with experienced Chicago real estate professionals

- Potentially avoiding deficiency judgments

3. Loan Modification

Contact your lender to discuss modifying your mortgage terms:

- Reduce monthly payments through interest rate reductions

- Extend the loan term to lower payments

- Add missed payments to the end of the loan

- Convert adjustable rates to fixed rates for predictability

4. Sell Your House Fast for Cash in Chicago

For Chicago homeowners who need immediate solutions, selling to a reputable cash buyer offers significant advantages:

Benefits of Cash Sales in Chicago:

- Close in as little as 7 days, well before foreclosure completion

- No need for costly repairs or renovations

- Avoid real estate agent commissions (typically 5-6% in Chicago)

- No financing contingencies that could delay or cancel the sale

- Sell “as-is” regardless of property condition

- Receive guaranteed closing dates to stop foreclosure proceedings

Own a bungalow on the South Side? A condo in River North? A multi-unit in Logan Square? Braddock Investment Group Inc buys all property types throughout Chicago and Cook County suburbs including Bridgeport, Oak Park, Evanston, and Skokie. Our Real Estate Acquisitions Specialist Aaron Buchanan will personally assess your property and present you with a written cash offer within 24 hours. Unlike other cash buyers, we’re based right here in Wicker Park at 1720 W Division Street and have been serving Chicago families since 2008. Text “STOP FORECLOSURE” to (312) 564-4058 or click here to fill out our online form for immediate assistance.

Why Chicago Homeowners Choose Cash Buyers

Chicago’s diverse housing market includes everything from historic bungalows on the South Side to modern condos in Millennium Park. Regardless of your property type or location, cash buyers can help in situations including:

Common Scenarios Where Cash Sales Help:

- Inherited Properties: Dealing with probate in Cook County can be complex, especially for properties needing repairs

- Divorce Situations: Quick, fair division of assets without prolonged market exposure

- Landlord Burnout: Tired of managing rental properties in competitive Chicago neighborhoods

- Relocation: Job transfers requiring immediate departure from Chicago

- Property Damage: Fire, flood, or other damage making traditional sales difficult

- Financial Hardship: Job loss, medical bills, or other financial emergencies

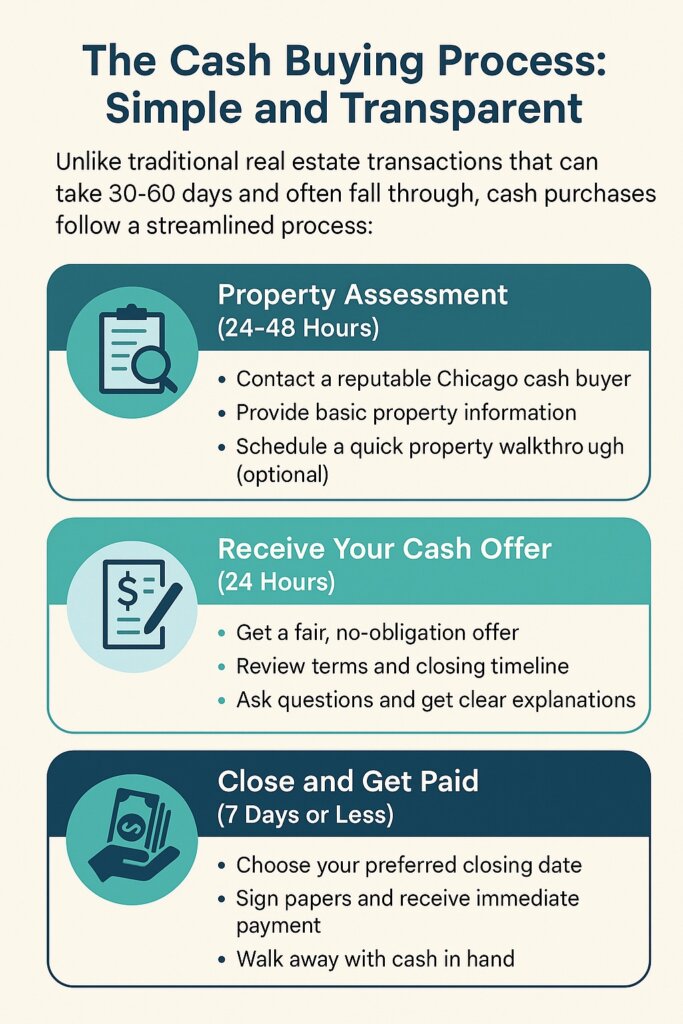

The Cash Buying Process: Simple and Transparent

Unlike traditional real estate transactions that can take 30-60 days and often fall through, cash purchases follow a streamlined process:

Step 1: Property Assessment (24-48 Hours)

- Contact a reputable Chicago cash buyer

- Provide basic property information

- Schedule a quick property walkthrough (optional)

Step 2: Receive Your Cash Offer (24 Hours)

- Get a fair, no-obligation offer

- Review terms and closing timeline

- Ask questions and get clear explanations

Step 3: Close and Get Paid (7 Days or Less)

- Choose your preferred closing date

- Sign papers and receive immediate payment

- Walk away with cash in hand

Protecting Yourself: Choosing the Right Chicago Cash Buyer

Not all cash buyers operate with the same standards. When selecting a company in Chicago, look for:

Red Flags to Avoid:

- High-pressure tactics or same-day decisions required

- Requests for upfront fees or payments

- Unrealistic promises about property values

- Lack of local Chicago references or testimonials

- No business license or professional credentials

Positive Signs of Reputable Buyers:

- Transparent process with clear explanations

- No-obligation offers and reasonable consideration time

- Local Chicago presence and market knowledge

- Positive reviews from previous Cook County clients

- Professional team including attorneys and title companies

Take Action Before It’s Too Late: How to Avoid Foreclosure

If you’re facing foreclosure in Chicago, time is your most valuable asset. The sooner you explore ways to stop foreclosure immediately, the more options you’ll have available. Cook County’s judicial foreclosure process provides several months to find solutions, but waiting until the sheriff’s sale is scheduled dramatically limits your ability to avoid foreclosure.

Immediate Steps to Take:

- Contact Your Lender: Discuss hardship programs or loan modifications

- Consult a HUD-Approved Housing Counselor: Free advice specific to your situation

- Get Multiple Cash Offers: Compare options from reputable Chicago buyers

- Speak with an Attorney: Understand your legal rights in Illinois foreclosure law

- Act Quickly: Don’t wait until you’re out of options

Ready to Explore Your Options?

If you’re asking yourself, “Should I give my house back to the bank in Chicago?” the answer is almost certainly no. Better alternatives exist that can protect your credit, provide immediate cash, and help you move forward with your life.

Get Your Fair Cash Offer Today

Don’t let foreclosure destroy your financial future. Contact Braddock Investment Group Inc today to learn how we can help you avoid foreclosure and get cash for your Chicago home in as little as 7 days.

📞 Call (312) 564-4058 for immediate assistance

💻 Visit our website to request your no-obligation cash offer

📧 Text us for quick responses to your questions

We’ve helped hundreds of Chicago homeowners avoid foreclosure across Cook County, from downtown condos to suburban single-family homes. Our local team understands Chicago’s unique market conditions and can provide solutions tailored to your specific situation.

Remember: You have options beyond foreclosure. The key is acting quickly while those options are still available.

Frequently Asked Questions About Chicago Foreclosure Alternatives

How long does foreclosure take in Illinois?

In Illinois, foreclosure is a judicial process that typically lasts 12 to 15 months from the initial court filing to the sheriff’s sale. This gives Chicago homeowners valuable time to explore solutions before losing their property.

Can I sell my house during foreclosure in Cook County?

Yes. Homeowners in Cook County can sell their home anytime before the sheriff’s sale. A cash sale is often the fastest option, with closings in as little as 7 days — quick enough to stop foreclosure in progress.

Will a deed in lieu of foreclosure hurt my credit?

A deed in lieu will still affect your credit, but it’s generally less damaging than a completed foreclosure. Most people see about a 50–100 point smaller drop in their score compared to foreclosure.

How much can I expect from a cash sale in Chicago?

Cash offers usually come in around 70–85% of market value, depending on property condition and demand. While less than retail value, cash deals save you money on repairs, realtor commissions, and months of holding costs.

Are there fees when selling to a cash home buyer?

No. Reputable cash buyers in Chicago don’t charge sellers any fees. Be cautious of anyone asking for upfront payments or hidden charges.

Can foreclosure be stopped once it starts in Cook County?

Yes. You can stop foreclosure up until the sheriff’s sale by paying the balance owed or selling the property. Cash sales are often fast enough to satisfy lender requirements before the deadline.

What are the best ways to stop foreclosure immediately?

In Chicago, the fastest foreclosure-stopping options include:

- Selling your house for cash (7-day closing)

- Filing Chapter 13 bankruptcy (automatic stay)

- Requesting an emergency loan modification

- Paying the full balance owed

- Legally challenging the foreclosure in court

Can I avoid foreclosure by selling my house in Chicago?

Yes. Selling your house is one of the most reliable ways to avoid foreclosure. A cash sale can close in 7 days or less, usually fast enough to stop Cook County foreclosure proceedings before the sheriff’s sale.

How can I stop foreclosure and keep my home?

To keep your home, consider these foreclosure alternatives:

- Loan modification to reduce payments

- Refinancing with a new lender

- Filing Chapter 13 bankruptcy to reorganize debt

- Repayment plans to catch up on missed payments

- Assistance from a HUD-approved housing counselor