Selling a home in the Chicago metropolitan area—whether in the city itself or northwest suburbs like Des Plaines, Morton Grove, Mount Prospect, Rolling Meadows, or Arlington Heights—involves navigating a complex escrow process that typically spans 30 to 45 days from contract acceptance to closing. For many homeowners across Cook County, this period represents both the most crucial and nerve-wracking phase of their home sale.

Understanding each step can help you prepare effectively and avoid common pitfalls that could delay or derail your transaction, regardless of whether you’re selling in Chicago’s bustling neighborhoods or the family-friendly communities of Arlington Heights, Des Plaines, Morton Grove, Mount Prospect, or Rolling Meadows.

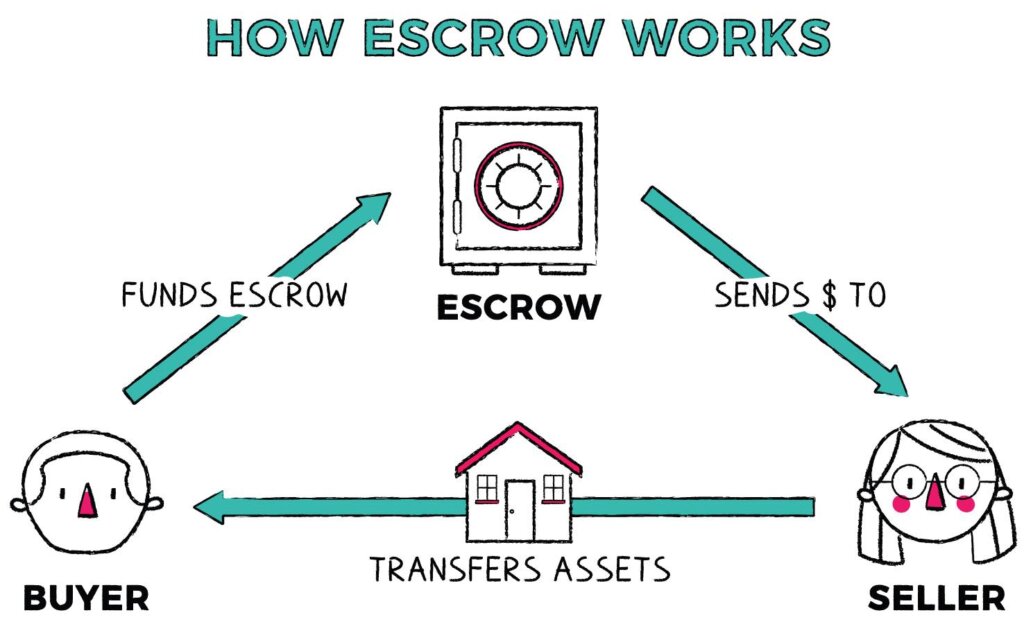

The escrow process serves as a neutral third-party system that protects both buyers and sellers during property transfers throughout Cook County. In Illinois, this process is governed by specific state regulations and local municipal ordinances that can influence timing and requirements across different communities.

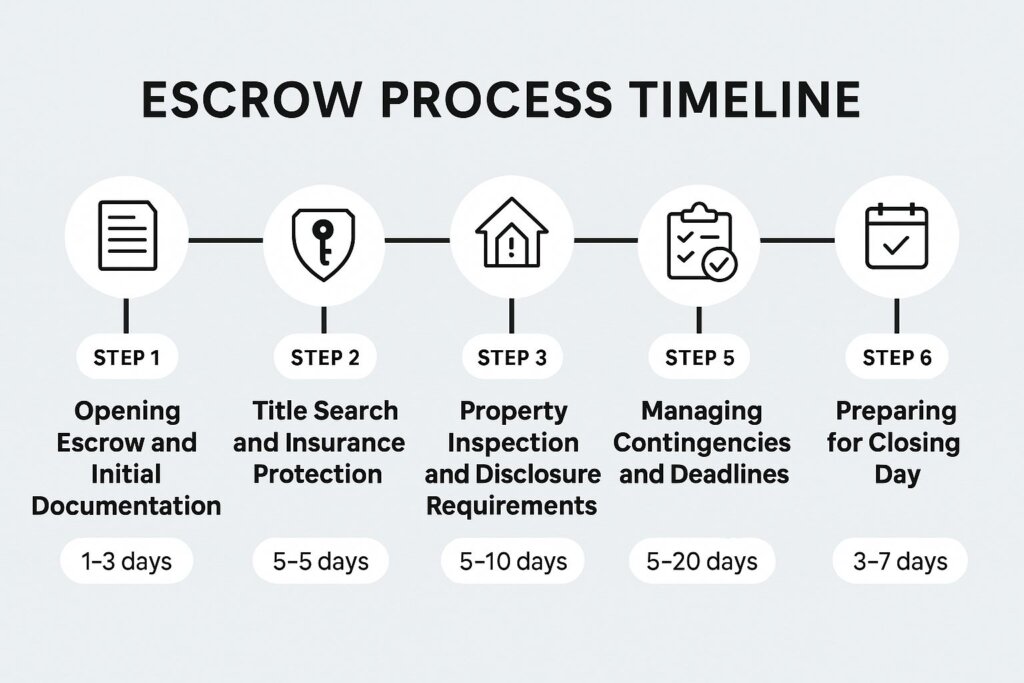

Step 1: Opening Escrow and Initial Documentation

The escrow process officially begins when your buyer’s agent or attorney submits the signed purchase agreement to the chosen escrow or title company. Throughout the Chicago metro area—from downtown Chicago to suburban communities like Arlington Heights and Des Plaines—many transactions utilize attorney-based closings rather than escrow companies, reflecting Illinois’ attorney-state status for real estate transactions.

During this initial phase, the escrow agent or closing attorney will:

- Create a file for your transaction

- Review the purchase agreement terms

- Send detailed instructions to all parties

- Establish timelines for contingencies and closing requirements

- Request necessary documentation from both buyer and seller

Sellers in municipalities like Morton Grove, Mount Prospect, and Rolling Meadows should expect to provide preliminary documentation including the deed, property tax records, and any homeowners association information. Municipal requirements can vary slightly between Chicago and suburban communities, with some suburbs having additional disclosure requirements for local assessments or utility districts.

Step 2: Title Search and Insurance Protection

Title examination represents one of the most critical components across all Cook County communities. Illinois requires a comprehensive title search extending back at least 40 years, though many title companies examine records dating back even further to ensure clear ownership, whether you’re selling in Chicago’s historic neighborhoods or newer developments in Arlington Heights or Rolling Meadows.

The title search process throughout the Chicago metro area involves:

- Examining public records at the Cook County Recorder’s Office

- Identifying any liens, judgments, or encumbrances

- Verifying property boundaries and legal descriptions

- Checking for unpaid property taxes or special assessments

- Confirming compliance with local building codes and permits across different municipalities

Each municipality may have specific requirements: Chicago properties often have more complex title histories, while suburban communities like Des Plaines, Morton Grove, Mount Prospect, Rolling Meadows, and Arlington Heights may have homeowners association liens or utility district assessments that require special attention.

Step 3: Property Inspection and Disclosure Requirements

Home inspections typically occur within 7-10 days of contract acceptance across all Chicago metro communities. Illinois law requires sellers to complete a Residential Real Property Disclosure Report, detailing known defects and property conditions, regardless of location within Cook County.

The inspection process covers standard elements but may focus on different concerns depending on location:

Chicago Properties: Often feature older construction requiring attention to lead paint, vintage electrical systems, and urban-specific concerns like shared walls or alley access.

Suburban Properties (Arlington Heights, Des Plaines, Morton Grove, Mount Prospect, Rolling Meadows): Typically emphasize different elements such as:

- Sump pump and basement waterproofing systems

- HVAC systems sized for larger suburban homes

- Garage door systems and driveways

- Landscaping and drainage issues

- Municipal water and sewer connections

Following inspection, buyers may request repairs or credits. Sellers should understand that certain issues, particularly those affecting habitability or safety, may require professional remediation before closing can proceed, with specific requirements varying by municipality.

Step 4: Property Appraisal and Market Valuation

When buyers obtain financing, lenders require professional appraisals to confirm the property’s market value supports the loan amount. The diverse Chicago metro market presents unique appraisal challenges due to varying conditions between urban Chicago and suburban communities.

Appraisers throughout Cook County consider multiple factors:

Chicago: Recent comparable sales within specific neighborhoods, proximity to transportation, urban amenities access, and local market trends.

Northwest Suburbs (Arlington Heights, Des Plaines, Morton Grove, Mount Prospect, Rolling Meadows): School district rankings, suburban amenities, commuter access to Chicago, neighborhood stability, and municipal services quality.

If appraisals come in below the contracted price, buyers and sellers must negotiate solutions across all communities, though suburban markets often show more pricing stability than urban areas.

Step 5: Managing Contingencies and Deadlines

Contingencies protect buyers by allowing contract cancellation under specific circumstances. Common contingencies in Chicago metro home sales include:

Financing Contingency: Typically lasting 21-30 days, allowing buyers to secure mortgage approval. Both urban Chicago and suburban markets often see shorter financing contingency periods in competitive conditions.

Inspection Contingency: Usually 7-10 days for professional property examination and negotiation of any necessary repairs.

Appraisal Contingency: Protects buyers if property values don’t support the purchase price.

Sale of Buyer’s Current Home: More common in suburban markets like Arlington Heights, Des Plaines, Morton Grove, Mount Prospect, and Rolling Meadows where buyers often own existing properties.

Sellers must track all contingency deadlines carefully across all municipalities, as missed deadlines can lead to disputes or transaction failures.

Skip the Contingency Stress: Work with Braddock Investment Group

While contingencies protect traditional buyers, they can create uncertainty and potential delays for sellers throughout the Chicago metro area. Braddock Investment Group offers a simpler alternative: we purchase homes with cash in Chicago, Arlington Heights, Des Plaines, Morton Grove, Mount Prospect, Rolling Meadows, and surrounding communities, eliminating financing contingencies, lengthy appraisal processes, and inspection-related delays. Our streamlined approach means you can close in as little as 7-14 days without worrying about deals falling through due to buyer financing issues or last-minute contingency concerns.

Ready to skip the uncertainty? Contact Braddock Investment Group today for a no-obligation cash offer on your Chicago area property. Or call us at (312) 564-4058.

Step 6: Preparing for Closing Day

The final phase involves coordinating multiple parties for a successful closing. Closings throughout the Chicago metro area typically occur at the office of the buyer’s attorney, title company, or occasionally at lending institutions, with suburban closings often offering more flexible scheduling than busy downtown Chicago offices.

Pre-closing activities include:

- Final walkthrough scheduling (usually 24-48 hours before closing)

- Utility transfer arrangements with respective municipal utilities

- Property maintenance through closing day

- Document preparation and review

- Fund verification and wire transfer coordination

Sellers should expect closing costs typically ranging from 1% to 3% of the sale price, though specific costs may vary between Chicago and suburban municipalities due to different transfer tax rates and local fees.

Estimate your closing costs with this real estate closing cost calculator.

Understanding Municipal-Specific Considerations

Several factors make each community’s escrow process unique:

Chicago Transfer Taxes: Chicago imposes both city and county transfer taxes totaling $5.25 per $500 of sale price for properties under $1 million, with higher rates for luxury properties.

Suburban Transfer Taxes: Communities like Arlington Heights, Des Plaines, Morton Grove, Mount Prospect, and Rolling Meadows typically only charge Cook County transfer taxes ($0.50 per $500), making suburban sales slightly less expensive from a tax perspective.

See the rest of the Cook County transfer tax information and municipal fee schedules here.

Building Code Compliance: Each municipality maintains its own building department:

- Chicago requires disclosure of any building code violations through the Department of Buildings

- Suburban communities may have different inspection requirements and violation resolution processes

- Some suburbs require municipal inspections for certain property types or age ranges

Timeline Expectations and Potential Delays

Most home sales throughout the Chicago metro area close within 30-45 days, though complex transactions or financing issues can extend this timeframe. Common delay factors include:

- Inspection-related repair negotiations

- Appraisal challenges in rapidly changing markets

- Financing complications or underwriting delays

- Title issues requiring resolution

- Municipal permit or violation concerns

- Weather-related delays affecting inspections or repairs (particularly relevant in suburban areas)

Working with Professional Partners

Successfully navigating the escrow process across Chicago and northwest suburbs requires coordination with qualified professionals familiar with local market conditions:

- Experienced real estate agents familiar with specific municipal requirements

- Qualified real estate attorneys specializing in Illinois law and local practices

- Reputable title companies with strong track records across Cook County

- Licensed inspectors knowledgeable about both urban and suburban building requirements

- Trusted contractors for any necessary repairs who understand local permit processes

Or Choose the Simpler Path with Braddock Investment Group

As you can see, the traditional escrow process involves multiple professionals, extensive paperwork, potential delays, and significant costs including agent commissions, attorney fees, inspection costs, and repair expenses—whether you’re selling in Chicago, Arlington Heights, Des Plaines, Morton Grove, Mount Prospect, Rolling Meadows, or anywhere in between. Braddock Investment Group eliminates these complexities entirely across all these communities.

Here’s how we make selling your Chicago area home easier:

- No repairs needed – We buy homes in any condition throughout Cook County

- No agent commissions – Keep more money in your pocket regardless of location

- No lengthy escrow process – Close in days, not weeks, in any municipality

- No financing contingencies – Cash offers mean guaranteed closings everywhere we serve

- No multiple professionals to coordinate – We handle everything from Chicago to the suburbs

- Familiar with local requirements – We understand the specific processes in each community we serve

Tired of the traditional selling hassles? Get a fast, fair cash offer from Braddock Investment Group. We serve Chicago, Arlington Heights, Des Plaines, Morton Grove, Mount Prospect, Rolling Meadows, and surrounding northwest Cook County communities. Call us today or visit the rest of our website to see how we can help you sell your home quickly and stress-free, no matter where you’re located.

Conclusion

The escrow process throughout the Chicago metropolitan area, while complex, follows predictable patterns that allow prepared sellers to navigate successfully toward closing. Whether you’re selling a Chicago condo, a suburban Arlington Heights colonial, a Des Plaines ranch, or family homes in Morton Grove, Mount Prospect, or Rolling Meadows, understanding each phase and municipal-specific requirements is crucial.

By familiarizing yourself with these steps and preparing accordingly, you can approach your home sale with confidence, knowing what to expect during the critical weeks between contract acceptance and closing day. Remember that while the process may seem daunting, thousands of successful real estate transactions close throughout these communities each year, and proper preparation is your best tool for joining their ranks.

Curious about the company behind hundreds of quick, successful closings throughout Chicago and the northwest suburbs? Discover Braddock Investment Group’s proven track record and streamlined approach that has helped countless homeowners skip the stress of traditional real estate sales. Don’t just take our word for it—read genuine testimonials and success stories from sellers across Cook County who chose our cash offer process and closed in under two weeks, avoiding months of escrow uncertainty, repair negotiations, and financing delays.

![we buy houses fast for cash [market_city]](https://image-cdn.carrot.com/uploads/sites/39968/2025/06/we-buy-houses-chicago-1920x800.jpeg)