AKA “How to Sell a Rental with Tenants (Without Losing Your Mind!)”

The rental property business has become increasingly challenging for individual landlords, with 33% of property owners planning to reduce or exit their portfolios in 2025. Rising operational costs, regulatory complexity, and tenant management challenges have created a perfect storm that’s driving record numbers of landlords to seek exit strategies from what was once considered a stable investment path.

If you’re among the millions of tired landlords selling property due to overwhelming management demands, you’re not alone. Recent industry data reveals that 18% of homes currently for sale were previously rental properties—the highest percentage on record—while landlord burnout rates continue climbing. Understanding your options for transitioning out of rental property ownership can provide the relief and financial freedom you’ve been seeking.

Recognizing the warning signs of rental property fatigue

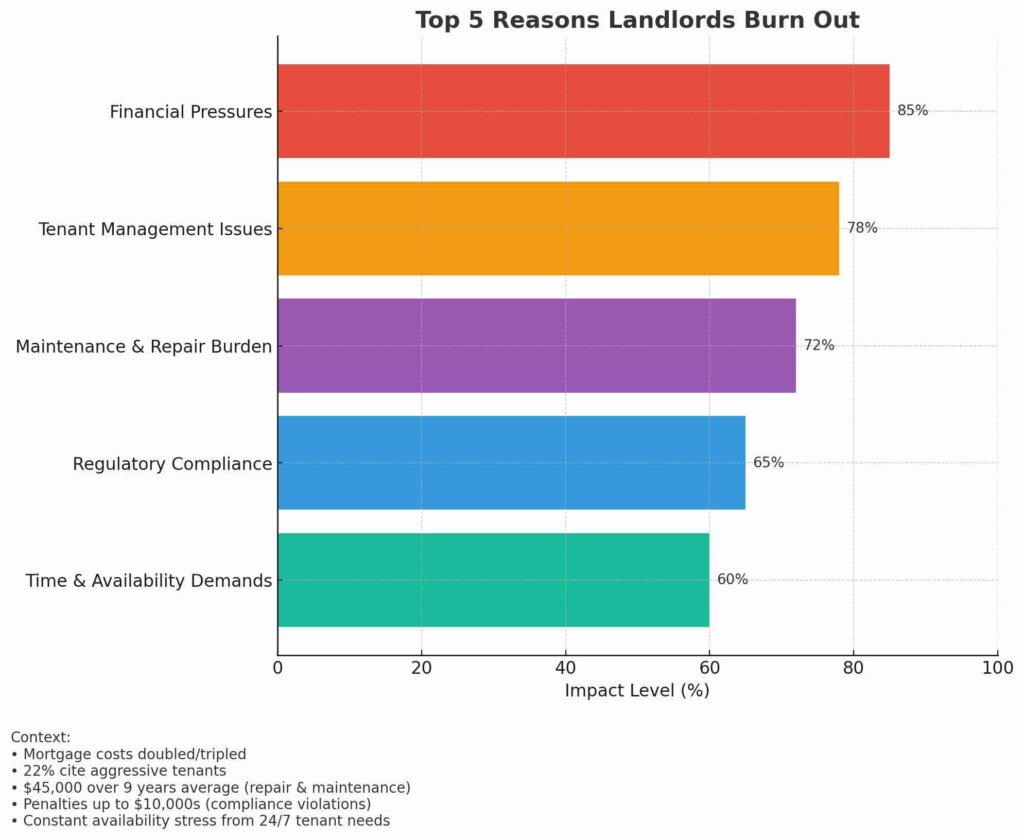

Landlord burnout manifests through multiple stress indicators that go beyond simple financial concerns. Property managers report that 22% cite aggressive or abusive tenants as their biggest challenge, while the constant availability demands of rental property ownership create chronic stress for individual landlords.

The warning signs often include feeling overwhelmed by maintenance requests, dreading tenant communications, losing sleep over property issues, and experiencing financial anxiety about unexpected expenses. Many landlords describe feeling trapped by properties that were supposed to provide passive income but instead demand constant attention and emotional energy.

Maintenance costs alone now average $1,374 per property annually, with damage repair costs increasing 121% between 2022-2024. When combined with rising insurance premiums, property taxes, and regulatory compliance expenses, many landlords find their profit margins shrinking while their responsibilities expand.

Ready to escape landlord stress? Contact Braddock Investment Group at (312) 564-4058 or fill out the form here to request your 24-hour cash offer.

The financial reality driving landlord exits in 2025

Multiple economic pressures have converged to make rental property ownership less attractive for individual investors. Investment property mortgage rates have doubled or tripled with interest rates above 6%, while changing tax regulations continue reducing profitability through various restrictions and compliance requirements.

Recent financial pressures include rising property taxes, increased insurance premiums averaging 20-30% annually, and maintenance costs that have skyrocketed due to inflation and labor shortages. These economic shifts, combined with stricter lending requirements for investment properties, have fundamentally altered the economics of small-scale rental property investment.

Tenant turnover costs now range from $1,750 to $5,000 per incident, while vacancy periods can cost upwards of $2,000 monthly in lost income. With national apartment turnover rates reaching 42-50%, these expenses have become significant drains on rental property profitability.

Market timing considerations for property sales

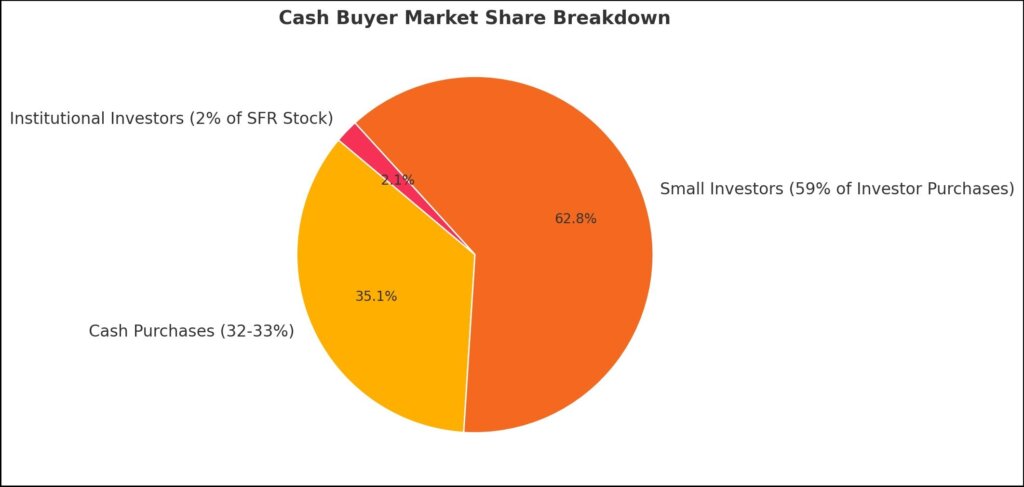

The current real estate environment presents unique opportunities for landlords considering property sales. Cash buyers represent 32-33% of all home purchases—a decade-high level that reflects strong demand from investors and individuals seeking to avoid financing complications.

Properties are spending an average of 38 days on market, with spring through early fall offering optimal selling conditions. The best timing within each month occurs during the first week, when buyer activity peaks with 3.7% more inquiries per available listing.

However, market timing extends beyond seasonal considerations. Current conditions include high mortgage rates keeping traditional buyers sidelined, making cash offers increasingly attractive to sellers seeking certainty. Pending home sale cancellation rates have reached 14% at the start of 2025, making cash transactions particularly valuable for avoiding deal failures.

Understanding your property sale options

Landlords have multiple pathways for exiting rental property ownership, each offering different advantages depending on individual circumstances and priorities.

Traditional real estate sales

Working with real estate agents provides maximum market exposure and potentially higher sale prices, but requires property preparation, staging, and longer timelines. Traditional sales typically take 30-60 days to close, with additional time needed for marketing and buyer qualification. Commission fees usually range from 5-6% of sale price, plus seller-paid closing costs and potential repair expenses.

Direct cash buyer transactions

When you need to sell rental property fast, cash buyers offer speed and certainty, typically closing within 7-30 days with no financing contingencies. Cash buyers often pay 90-95% of market value, providing competitive pricing while eliminating common sale complications. Properties can be sold “as-is” without repairs or improvements, and many cash buyers handle all closing costs.

Among the best companies that buy houses for cash are established local investors, national iBuyer platforms, and specialized rental property buyers who understand the unique challenges landlords face.

Institutional investor sales

Large investment companies purchase portfolios or individual properties for cash, often specializing in tenant-occupied properties. These buyers understand rental property economics and allow you to sell house with tenants in place, eliminating the need for vacancy periods or lengthy eviction processes. This option is particularly valuable for landlords who want to sell house with bad tenants without going through the stress of tenant removal.

iBuyer platforms

Technology-enabled companies like Opendoor and Offerpad provide instant offers within 24-48 hours, though typically at 70-80% of market value. These platforms offer maximum convenience and speed but at a significant pricing discount compared to other options.

The growing cash buyer market

The cash buyer landscape has evolved significantly, providing landlords with sophisticated exit strategies. Major institutional investors now own roughly 2% of single-family rental stock nationally, with concentrations reaching 25% in markets like Atlanta.

Institutional buyers include publicly traded companies like Invitation Homes (80,000+ properties) and American Homes 4 Rent (60,000+ properties), along with technology-enabled platforms specializing in quick acquisitions. These buyers often purchase properties with existing tenants, handling property management transitions seamlessly.

Small investors owning 10 or fewer properties represent 59% of all investor purchases, indicating strong demand from individual buyers seeking rental properties. This creates a robust market for landlords looking to sell, with multiple buyer categories competing for inventory.

Operational challenges accelerating landlord exits

Beyond financial pressures, operational challenges have made rental property management increasingly difficult for individual landlords. US landlords now spend an average of $45,000 over nine years of ownership on various maintenance tasks, while emergency repairs have increased 15% in response time due to contractor shortages.

Regulatory compliance has become particularly burdensome, with new requirements varying by state and municipality. Local ordinances increasingly require rental licensing, regular inspections, and enhanced tenant protections, while enforcement penalties can reach tens of thousands of dollars for repeat violations.

Tenant management challenges include dealing with non-payment issues, aggressive behavior, and complex eviction processes that can take months to resolve. Water and leak emergencies account for 72% of all emergency repairs, averaging $700 annually, while property damage can cost $1,500 per year for affected properties.

Professional solutions for stressed landlords

For landlords in the Chicago area experiencing rental property burnout, specialized companies like Braddock Investment Group offer targeted solutions to sell problem rental property quickly and efficiently. Founded in 2008 during the Great Recession, the company understands the challenges facing individual landlords and provides cash purchase options specifically designed for rental property owners.

Braddock Investment Group purchases properties with existing tenants, eliminating the stress of tenant management and eviction processes. Their 24-hour cash offers and 7-10 day closing timeline provide immediate relief for landlords seeking quick exits from problematic properties. The company covers all closing costs and purchases properties “as-is,” removing the financial burden of repairs and improvements.

This approach is particularly valuable for landlords dealing with difficult tenants, properties needing extensive repairs, or situations requiring quick asset liquidation. With 15+ years of experience in the Chicago market and hundreds of completed transactions, they offer specialized expertise in landlord exit strategies.

Making the transition from property ownership

Successfully exiting rental property ownership requires careful planning and consideration of tax implications, timing factors, and personal financial goals. Capital gains strategies become crucial when disposing of rental properties, particularly given recent changes in tax laws and depreciation recapture requirements.

Consider consulting with tax professionals about timing sales across multiple tax years, utilizing available deductions, and potentially using proceeds for other investment vehicles. Some landlords choose to sell properties gradually rather than liquidating entire portfolios simultaneously, allowing for better tax management and cash flow planning.

Document all property expenses, improvements, and depreciation for accurate capital gains calculations. Keep detailed records of selling expenses, including repairs, agent fees, and professional services, as these can reduce taxable gains.

Alternative investment strategies after selling

Many former landlords successfully transition to alternative investment approaches that provide income without direct property management responsibilities. Real Estate Investment Trusts (REITs) offer exposure to property markets through stock purchases, providing liquidity and professional management.

Dividend-focused stock portfolios can generate income streams similar to rental yields while eliminating operational responsibilities. Bond ladders provide predictable income with various maturity dates, while index funds offer broad market exposure with minimal management requirements.

Some former landlords invest in crowdfunded real estate platforms, maintaining property exposure while delegating all management responsibilities to professional operators. These platforms often require lower minimum investments than direct property ownership while providing geographic diversification.

Conclusion

The current environment presents unique opportunities for landlords seeking relief from rental property stress. With strong cash buyer demand, favorable market conditions, and specialized companies offering tailored solutions, landlords have viable pathways to exit rental property ownership while preserving their financial gains.

The key is recognizing when rental property ownership no longer serves your financial or personal goals. Whether due to operational stress, changing life circumstances, or evolving investment preferences, multiple exit strategies can provide the freedom and financial security you’re seeking.

For landlords in the Chicago area ready to explore their options, Braddock Investment Group offers specialized cash purchase services designed specifically for rental property owners. Their experienced team understands the unique challenges facing today’s landlords and provides swift, professional solutions.

Contact Braddock Investment Group at (312) 564-4058 or visit their website to request your 24-hour cash offer. Take the first step toward eliminating rental property stress and reclaiming your time, energy, and peace of mind. Your future self will thank you for making the decision to prioritize your well-being over property management obligations.